oregon college savings plan tax deduction 2018

The tax credit provides the same maximum credit to all Oregonians who are saving for college community college trade school or any other post-secondary education through. Oregon state income tax deduction is available for contributions up to 4750year Married filing jointly and 2375year all other filers for 2018.

529 Plans Without The Fossil Fuels Alternative Energy Stocks

The Oregon College Savings Plan is moving to a tax credit starting January 1 2020.

:max_bytes(150000):strip_icc()/PrivateCollege529Plan-0408a91482914cfb957348bfc19dd36b.jpg)

. The Vanguard 529 College Savings Plan NV Oregon College Savings Plan OR Maximum annual state deduction. Explore the benefits and see how saving for your kids future can help come tax season. For example if a couple contributed 15000 to their childs Oregon College.

You may elect to carry forward a balance over the following four years for contributions made before the end of 2 019 in order to help distribute your tax deduction potential. See Additions to tax in. A short digital video to highlight the tax savings when you open an Oregon College Savings Plan for your child.

Contributions must be made to an Oregon 529 plan in order to qualify. By Springwater Wealth Feb 27 2018. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan account.

The tax credit provides the same maximum credit to all Oregonians who are saving for college community college trade school or any other post-secondary education. If you file an Oregon income tax return contributions made to your account before the end of 2019 are deductible up to a certain limit. Your 2017 Oregon tax is due April 17 2018.

Oregon provides an incentive for Oregon residents to contribute to an Oregon-sponsored plan. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option. All Oregon taxpayers are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers on contributions made to their Oregon College Savings Plan account.

100 Free Federal for Old Tax Returns. Additional tax benefits are available to Oregon residents in the form of. The new tax credit would be in addition to any carried forward deductions.

You can also follow the PCC Shuttles on Twitter. Compound interest adds up. Beginning on Jan.

There is no personal income tax in Nevada. Oregon doesnt allow an exten-sion of time to pay your tax even if the IRS is allowing an extension. Contributions and rollover contributions up to 2330 for 2017 for a single return and up to 4660 for a joint return are deductible from Oregon state income tax.

Starting January 1st 2020 the Oregon College Savings Plan is moving to a tax credit. Go Paperless Fill Sign Documents Electronically. Oregon is tied to December 31 2016 federal income tax laws.

With the Oregon College Savings Plan your earnings can grow tax-free. Oregon 529 college savings plan nonqualified. Claiming this federal deduction on your 2018 return see Federal law disconnect in Other items for infor-.

Plus you can get up to a 300. All Extras are Included. If you are a resident of Oregon contributions made to any account in the Oregon College Savings Plan are eligible to receive a state income tax credit up to 300 for joint filers and up to 150 for single filers.

Best 529 plans of. 1 2018 the state income tax deduction for contributions made to a CollegeAdvantage 529 plan doubles from 2000 to 4000 per beneficiary per year. Thats despite a federal tax break approved in December as part of a.

Tax benefits that make a difference. It is now possible to use a 529 plan to pay up to 10000 per year per student for private school tuition for kindergarten through 12th grade. Minimum contributions if you use payroll deduction are only 15.

The state tax deduction for contributions to the. Oregon allows state residents to deduct annual contributions they make to any Oregon 529 plan from their state income taxes. State tax benefit.

Currently you can contribute until your account balance is 310000 or higher in your Oregon 529 plan. LLC succeeded TIAA-CREF as program manager of the Oregon College Savings Plan on September 10 2018. Oregon has a rolling tie to federal changes made to the definition of taxable.

Premium Federal Tax Software. School closures portland oregon Delays or changes to the PCC Shuttle routes will be posted to the live shuttle tracker. There is also an Oregon income tax benefit.

Oregon parents wont get a state tax break on money they save to pay for K-12 private schooling lawmakers have decided. Keep in mind the carried-forward deduction may only be taken if the Oregon College Savings Plan account balance is greater than the deduction amount at the end of the tax year in which the. And if youre using it for higher education expenses your savings can be spent tax-free too.

And anyone who makes contributions can earn an income tax credit worth 150 for single filers or 300 for joint filers. Parents and students contribute to 529 accounts and if the accounts increase in value they. The Oregon College Savings Plan and Tax Reform.

Last date to file individual refund claims for tax year 2018. 6 Oregon College Savings Plan Disclosure Booklet4 There are no other recurring fees if one chooses to manage the account online and receive statements and withdrawals electronically. Ad Prepare your 2018 state tax 1799.

For 2019 the limit individual taxpayers are allowed to deduct is 2435 or 4865 if filing jointly. They can then carry forward the remaining 10135 balance of that contribution for up to four years. Federal tax law No extension to pay.

With the Oregon College Savings Plan your account can grow with ease. If you claimed a tax credit based on your contributions to an Oregon College or MFS 529 Savings Plan account or an ABLE account and later made a nonqualified withdrawal of those contributions your credits may have to be recaptured. 529 Plan Ratings and Rankings.

The state tax subtraction for contributions to the Oregon College Savings Plan or MFS Oregon 529 Plan increases in 2016 to 2310 for a single taxpayer and 4620 for couples filing jointly the. As we mentioned in an earlier post Congress made changes to 529 education plans when it passed The Tax Cuts and Jobs Act in December 2017. The changes apply to 529 accounts which Congress created to encourage tax-free savings for college.

Ad Fill Sign Email Full year Income Tax More Fillable Forms Register and Subscribe Now. Oregon college savings plan.

How Does Divorce Affect 529 College Savings Plans Shapiro Law Firm

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

Everything You Need To Know About 529 College Savings Plans In 2021

Faqs Oregon College Savings Plan

3 Reasons To Stash Your Cash In A 529 Instead Of A Regular Savings Account

Edvest Wisconsin 529 College Savings Plan Ratings Tax Benefits Fees And Performance

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

529 Plan Deductions And Credits By State Julie Jason

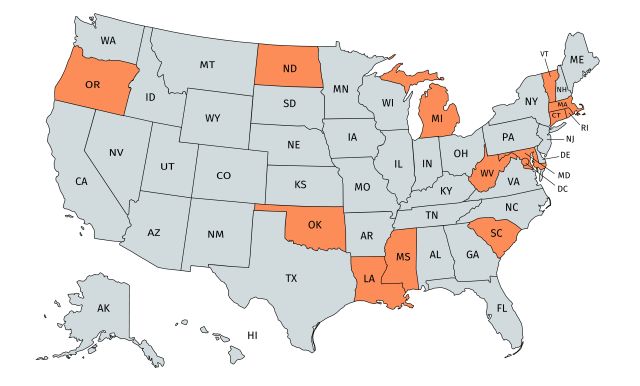

Using A 529 Plan From Another State Or Your Home State

529 Plan Advertisements And Marketing Collateral

Can I Use A 529 Plan For K 12 Expenses Edchoice

Can I Use A 529 Plan For K 12 Expenses Edchoice

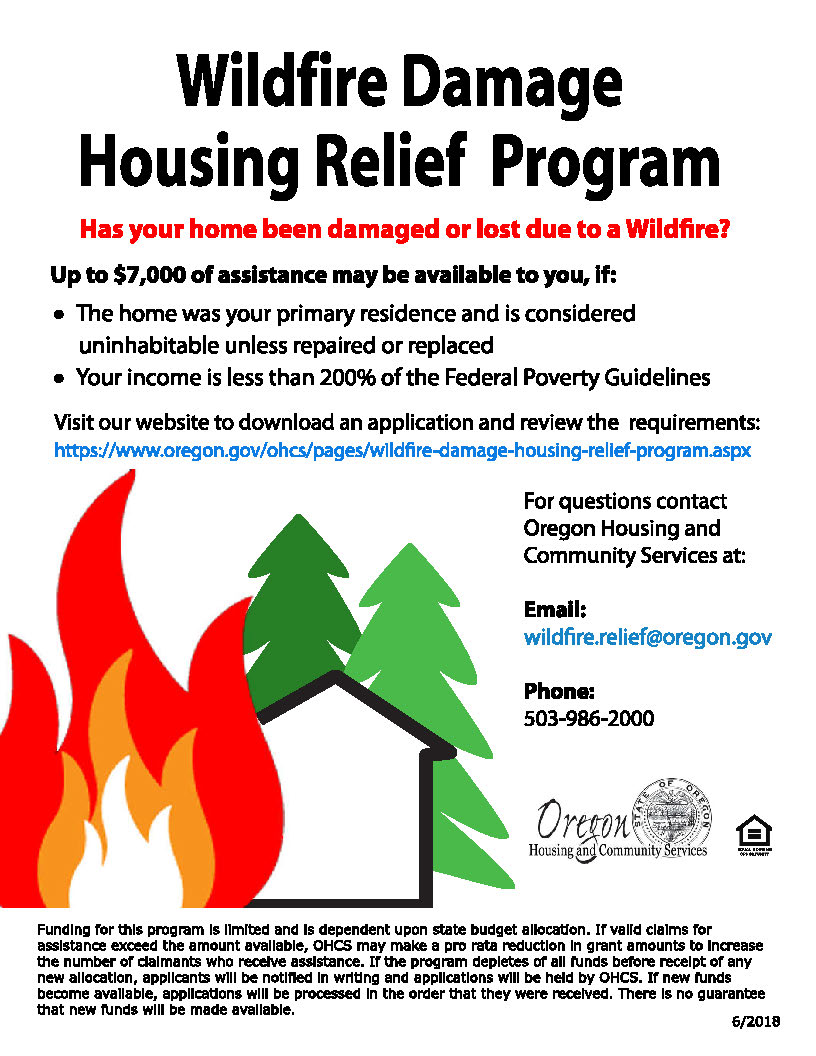

Wildfire Housing Relief 529 Savings Plan Updates State Fair More

Can You Use A 529 Plan To Pay For Study Abroad

The Best 529 Plans Of 2022 Forbes Advisor

Oregon Won T Allow 529 Tax Breaks For K 12 Private School Oregonlive Com

:max_bytes(150000):strip_icc()/OregonCollegeSavingsPlan-4977e352c0014ce3993beb4e0832e733.jpg)